What Debts Cannot Be Discharged By Bankruptcy

Discover which debts cannot be eliminated through bankruptcy, including child support, taxes, student loans, and more. Learn about Chapter 7 vs Chapter 13 and alternatives to bankruptcy filing.

Thinking about filing for bankruptcy? I get it - when debt becomes overwhelming, bankruptcy can feel like your only lifeline to financial freedom. But here's something many people don't realize until it's too late: not all debts disappear when you file for bankruptcy.

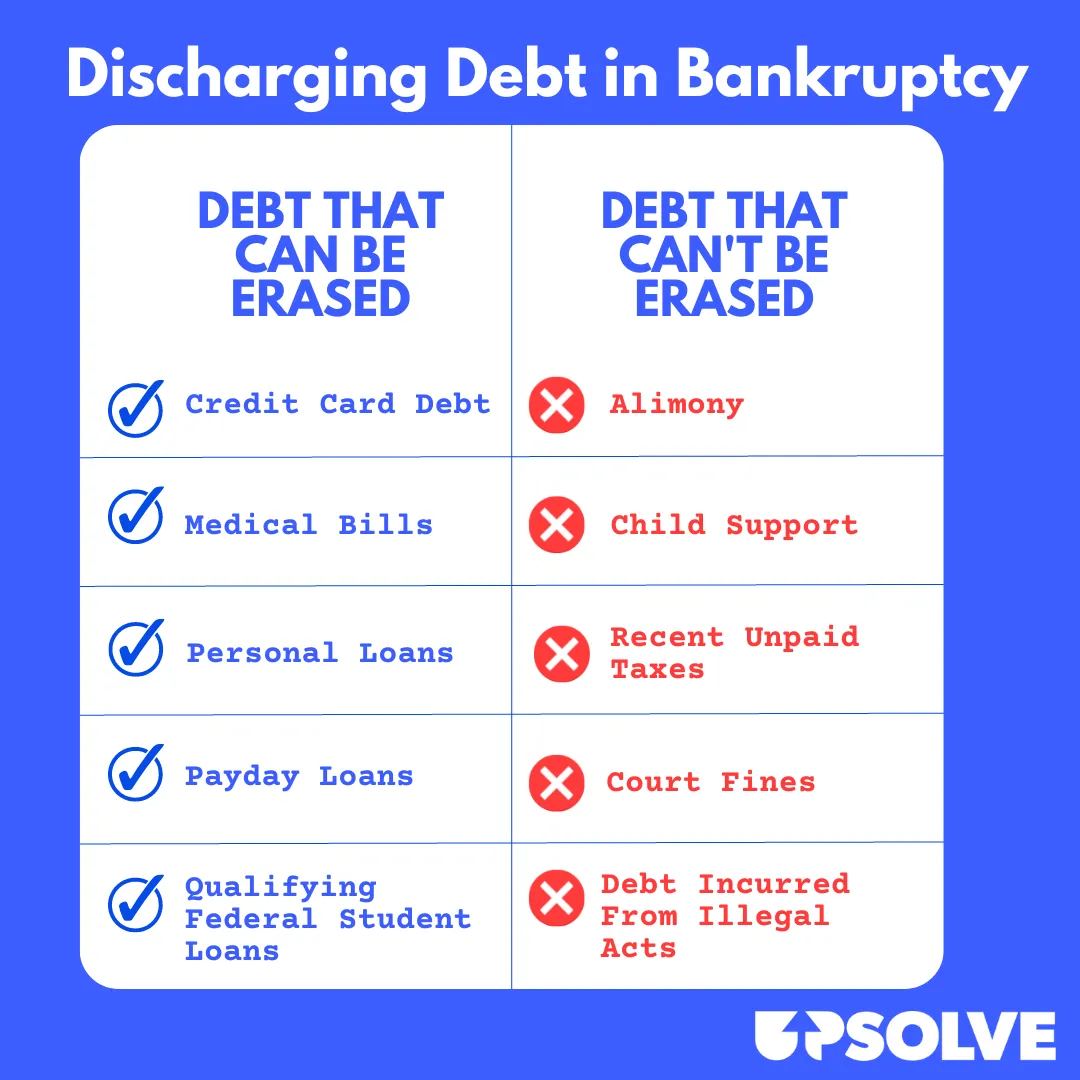

While bankruptcy can wipe out credit cards, medical bills, and personal loans, there's a whole list of debts that will stick around even after your discharge. Understanding which debts cannot be eliminated is crucial before you make this life-changing decision.

In this guide, I'll walk you through exactly which debts survive bankruptcy, explain the differences between Chapter 7 and Chapter 13, and share some alternatives that might work better for your situation. Whether you're drowning in debt or just exploring your options, this information could save you from costly surprises down the road.

Table of Contents

- Understanding Bankruptcy Basics

- Chapter 7 vs Chapter 13: Key Differences

- Debts That Cannot Be Discharged

- Difficult to Discharge Debts

- Special Situations and Exceptions

- Alternatives to Bankruptcy

- Making the Right Decision

- Final Thoughts

Understanding Bankruptcy Basics

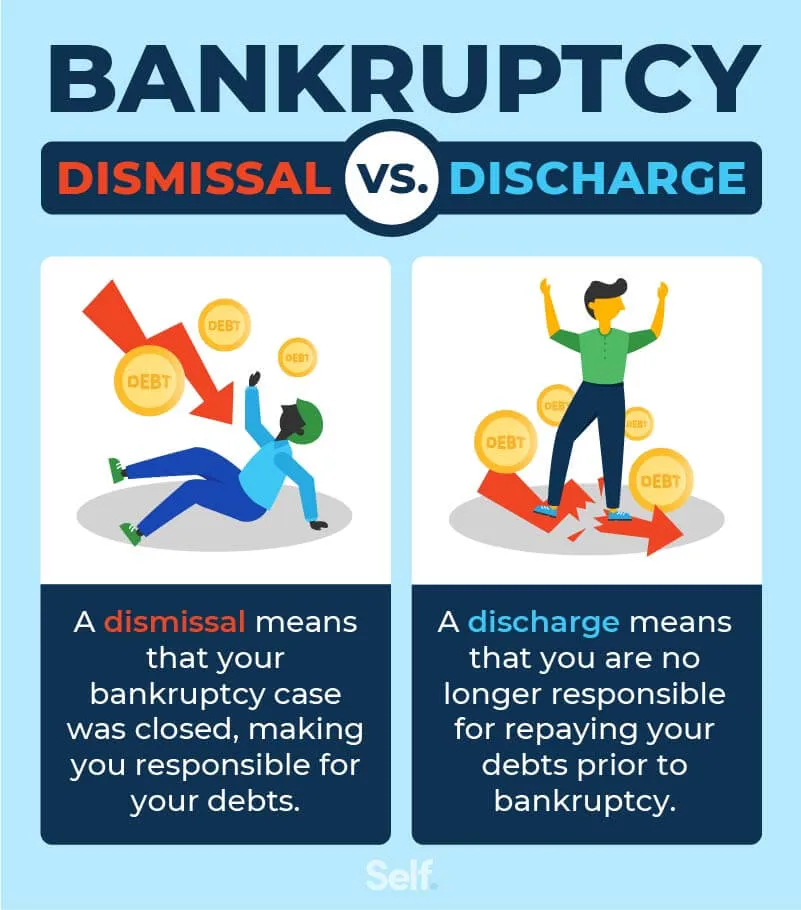

Bankruptcy isn't just about wiping out debt - it's a legal process designed to give honest debtors a "fresh start" while protecting creditors' rights. The U.S. Bankruptcy Code lists 19 different categories of debts that cannot be discharged, and understanding these exceptions is crucial.

When you file for bankruptcy, an "automatic stay" immediately stops most collection activities. Creditors can't call you, sue you, or garnish your wages. It's like hitting a pause button on your financial chaos. However, this protection doesn't extend to all types of debt.

The whole system operates on the principle that while society wants to help people overcome financial hardship, certain obligations are too important to society to simply erase. Think of it this way: if someone could discharge child support or drunk driving penalties through bankruptcy, it would undermine important social policies.

Most people filing for bankruptcy choose between Chapter 7 (liquidation) and Chapter 13 (reorganization). Both have the same basic rules about which debts cannot be discharged, though there are some subtle differences we'll explore.

Chapter 7 vs Chapter 13: Key Differences

Chapter 7 bankruptcy is often called "liquidation bankruptcy." If you qualify (and most people do), your non-exempt assets get sold off to pay creditors, and your remaining eligible debts get wiped out. The whole process typically takes about four months from filing to discharge.

To qualify for Chapter 7, you must pass a "means test" that proves you don't have enough income to repay your debts. If your current monthly income is above your state's median, you'll need to show that after allowed expenses, you don't have at least $17,150 (or 25% of your unsecured debt) left over annually.

Chapter 13 bankruptcy works differently. Instead of liquidating assets, you propose a 3-5 year repayment plan to pay back a portion of your debts. You get to keep your property, but you must have regular income to make the monthly payments. At the end of the plan period, remaining eligible debts get discharged.

Here's what's interesting: the same types of debts that can't be discharged in Chapter 7 generally can't be discharged in Chapter 13 either. However, Chapter 13 can sometimes help you catch up on mortgage payments or car loans through your repayment plan.

The choice between chapters often comes down to your income level and what you want to protect. If you want to keep your house but are behind on payments, Chapter 13 might be better. If you just want a quick fresh start and don't have many assets, Chapter 7 could be the way to go.

Debts That Cannot Be Discharged

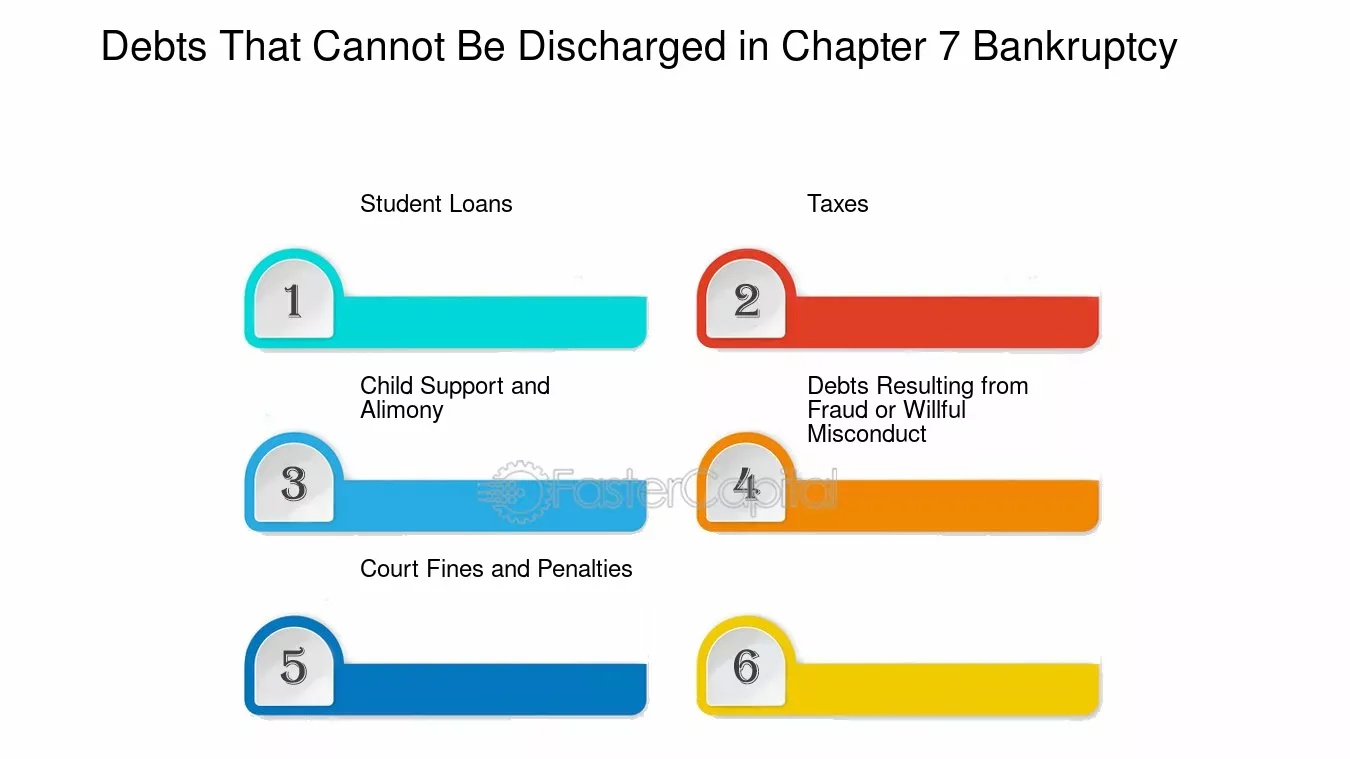

Let's get straight to the point - here are the debts that will survive your bankruptcy no matter which chapter you file:

Child Support and Alimony

Family support obligations are considered sacred in bankruptcy law. Whether it's current child support, back support, or spousal maintenance, you'll continue owing every penny after bankruptcy. This includes any lump-sum awards from divorce proceedings.

The reasoning is straightforward: these debts protect vulnerable family members who depend on this support for basic needs. No bankruptcy court will allow someone to escape these fundamental family responsibilities.

Certain Tax Debts

Most tax debts cannot be discharged, though there are some exceptions for older income taxes. Tax liens will definitely survive bankruptcy. If the IRS has placed a lien on your property, bankruptcy won't remove it.

However, some federal, state, and local income taxes can be discharged if they meet specific criteria: the tax return was due at least three years ago, you filed the return at least two years ago, and the tax was assessed at least 240 days ago. Property taxes and payroll taxes, though, typically cannot be discharged.

Student Loans

Student loan debt has become notoriously difficult to discharge in bankruptcy. For years, it was nearly impossible. However, new guidance from the Department of Justice in November 2022 has made it somewhat easier to discharge student loans if you can prove "undue hardship."

According to recent data, 99% of the 632 applicants using the new streamlined process have had at least some of their student loan debt discharged in the first 10 months. You'll need to file a separate lawsuit called an "adversary proceeding" within your bankruptcy case.

Debts from Fraud, Theft, or Embezzlement

If you obtained money or property through fraud, theft, or embezzlement, those debts will survive bankruptcy. This includes debts from credit card fraud, check fraud, or any situation where you intentionally deceived someone to get money or credit.

The creditor must file a complaint in your bankruptcy case to get a determination that the debt is non-dischargeable due to fraud. They have 60 days after the first meeting of creditors to do this.

Personal Injury Debts from Drunk Driving

Any debts for death or personal injury caused while you were driving under the influence cannot be discharged. This applies to both alcohol and drug impairment. These debts recognize that drunk driving is a serious public safety issue with lasting consequences for victims.

Court Fines and Criminal Restitution

Fines, penalties, or restitution ordered by a court in a criminal case cannot be discharged. This includes traffic tickets, criminal fines, and any restitution you owe to victims of crimes.

Unlisted Debts

Here's a trap many people fall into: if you forget to list a debt in your bankruptcy petition, it won't be discharged. The bankruptcy court can only discharge debts it knows about. Always double-check your schedules to make sure every debt is included.

As financial expert Morgan Housel explains in Morgan Housel's "The Psychology of Money" Book, "The hardest financial skill is getting the goalpost to stop moving." This applies perfectly to bankruptcy - you want to make sure you've identified all your debts so the goalpost of financial freedom doesn't keep moving.

Difficult to Discharge Debts

Some debts fall into a gray area - they're not automatically non-dischargeable, but creditors can challenge them:

Debts from False Pretenses

If you obtained credit by lying on an application or providing false information, the creditor can file a complaint to have that debt declared non-dischargeable. However, the creditor must prove you intentionally deceived them.

Courts look at factors like whether the false statement was material to the creditor's decision, whether the creditor reasonably relied on it, and whether you intended to deceive. Simply overstating income slightly on a credit application might not rise to the level of fraud.

Luxury Purchases Before Bankruptcy

Credit card purchases of more than $800 for luxury goods or services made within 90 days before filing are presumed to be non-dischargeable. Cash advances over $1,100 within 70 days of filing face the same presumption.

"Luxury goods" doesn't mean they have to be expensive - it means they're not reasonably necessary for your family's support or maintenance. A new TV right before bankruptcy? Probably a luxury. Groceries or medical expenses? Definitely necessities.

Willful and Malicious Injury

Debts arising from willful and malicious injury to another person or their property cannot be discharged in Chapter 7. In Chapter 13, this only applies to personal injury - property damage debts might be dischargeable.

The key words are "willful and malicious" - this means you intended to cause harm without just cause. Accidentally causing injury wouldn't qualify, but punching someone in a fit of road rage would.

Special Situations and Exceptions

Secured Debts and Reaffirmation

Secured debts like mortgages and car loans work differently in bankruptcy. While the personal liability for these debts can be discharged, the lien on the property survives. This means the lender can still repossess the car or foreclose on the house if you don't pay.

If you want to keep secured property, you might choose to "reaffirm" the debt. Reaffirmation is a legal agreement that you'll continue paying the debt as if you never filed bankruptcy. Be very careful with reaffirmation - you're giving up the protection bankruptcy provides for that debt.

Joint Debts and Guarantors

If you have joint debts with someone else (like a spouse or business partner), your bankruptcy only eliminates your liability. The other person remains fully responsible for the entire debt. Creditors will pursue them for the full amount.

If someone guaranteed a loan for you, your bankruptcy eliminates your obligation but not theirs. The guarantor will still be on the hook. Conversely, if you guaranteed someone else's loan and they default, that debt is typically dischargeable in your bankruptcy.

Business Debts and Partnerships

Business debts can usually be discharged in personal bankruptcy if you're personally liable for them. However, if you operated as a partnership, things get more complex. Partners can file joint bankruptcy applications, but all partners must agree.

Post-Bankruptcy Debts

Any debts you incur after filing for bankruptcy are not covered by the discharge. This seems obvious, but it catches some people off guard. If you rack up new credit card debt or get new loans during your bankruptcy case, you'll be personally liable for those debts.

Alternatives to Bankruptcy

Before filing for bankruptcy, consider these alternatives that might work better for your situation:

Debt Settlement

Debt settlement involves negotiating with creditors to accept less than the full amount owed. This can work well if you have some money available (perhaps from selling assets or borrowing from family) but not enough to pay all your debts in full.

The downside is that forgiven debt is usually taxable income, and the process can take months or years. However, it won't stay on your credit report as long as bankruptcy.

Debt Management Plans

Credit counseling agencies can help you set up debt management plans where they negotiate lower interest rates and monthly payments with your creditors. You make one monthly payment to the agency, which distributes it to your creditors.

These plans typically take 3-5 years to complete and require you to stop using credit cards during the program. They're best for people with steady income who just need help organizing their debts.

Negotiating Directly with Creditors

Sometimes creditors are willing to work out payment plans or settlements directly. This is especially true for medical debts and some credit card debts. The key is to contact them before you're too far behind.

Many people don't realize creditors often prefer to get something rather than nothing. They might accept a lump sum payment for 30-50% of the balance, or they might agree to a long-term payment plan with reduced interest.

As Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence teaches us, sometimes the best financial decisions require honest conversations - including with creditors.

Tax Relief Programs

If taxes are your main problem, the IRS offers several programs that might be better than bankruptcy:

- Offer in Compromise: The IRS accepts a lesser amount than you owe

- Installment Agreements: Spread payments over time

- Currently Not Collectible Status: Temporarily suspend collection if you're experiencing financial hardship

These programs can be more effective than bankruptcy for tax debts, and they won't have the same long-term impact on your credit.

Making the Right Decision

Choosing whether to file bankruptcy isn't just about eliminating debt - it's about creating a sustainable financial future. Here are the key factors to consider:

Analyze Your Non-Dischargeable Debts

Before filing, calculate exactly how much of your debt cannot be discharged. If the majority of your debt consists of child support, student loans, and recent taxes, bankruptcy might not provide the relief you're hoping for.

For example, if you owe $100,000 in total debt but $80,000 is student loans and child support, bankruptcy will only eliminate $20,000. In that case, you might be better off exploring income-driven repayment plans for student loans and working directly with other creditors.

Consider Your Long-Term Goals

Bankruptcy stays on your credit report for 7-10 years, affecting your ability to get mortgages, car loans, and sometimes even employment. Think about your goals for the next decade. Are you planning to buy a house? Start a business? These plans might be more difficult after bankruptcy.

However, if you're already behind on payments and your credit is damaged, bankruptcy might actually help you rebuild faster than struggling with unmanageable debt for years.

Evaluate Your Income Stability

If you have steady income and your main problem is just too much debt relative to your income, Chapter 13 might work well. You'll pay what you can afford for 3-5 years, then get a discharge of remaining eligible debts.

If your income is unstable or very low, Chapter 7 might be better. You'll get a quicker discharge and can start rebuilding immediately.

Professional Guidance Matters

Bankruptcy law is complex, and the consequences are long-lasting. Consider consulting with a bankruptcy attorney even if you're just exploring options. Many offer free consultations and can help you understand how bankruptcy would work in your specific situation.

A good attorney can also help you time your bankruptcy filing strategically. For example, if you have tax debts that might become dischargeable in a few months, waiting could save you thousands of dollars.

As discussed in The Intelligent Investor - Benjamin Graham, making financial decisions requires careful analysis of all factors, not just the immediate problem. This principle applies perfectly to bankruptcy decisions.

Final Thoughts

Understanding which debts cannot be discharged by bankruptcy is crucial for anyone considering this option. While bankruptcy can provide powerful relief from overwhelming debt, it's not a magic solution that eliminates all financial obligations.

The key debts that survive bankruptcy - child support, most tax debts, student loans, and debts from fraud or drunk driving - reflect important societal values about personal responsibility and protecting vulnerable people.

Before filing, carefully calculate how much of your debt would actually be eliminated. Consider alternatives like debt settlement, payment plans, or tax relief programs. And remember that bankruptcy, while sometimes necessary, is just one tool in your financial toolkit.

If you do decide bankruptcy is right for you, work with a qualified attorney to navigate the process properly. Make sure all eligible debts are listed in your petition, understand which debts will survive, and have a plan for handling non-dischargeable obligations.

Most importantly, use bankruptcy as an opportunity to build better financial habits. As the saying goes, "It's not about the money you make, but the money you keep." Whether you file bankruptcy or pursue alternatives, focus on creating a sustainable budget and emergency fund to avoid future financial crises.

Remember, millions of Americans have successfully rebuilt their financial lives after bankruptcy. While it's not an easy path, it can be the right choice when other options aren't viable. The key is making an informed decision based on your complete financial picture, not just the debts that are bothering you most right now.

For more insights on managing debt and building financial stability, check out our related guides on ways to get out of debt and which debts to pay off first.