What is Blockchain, How They Work and Where They Are and Can Be Used

Complete guide on blockchain: understand the concept, functioning, types of networks, practical applications and differences between public and private blockchain.

Blockchain is a revolutionary technology that functions as a distributed and immutable database, organizing information in blocks interconnected by cryptography. This technological innovation enables secure and transparent transactions without the need for intermediaries, being the fundamental basis of cryptocurrencies like Bitcoin and various other applications.

What is Blockchain?

Blockchain, literally translating from English, means "chain of blocks." It is a digital recording system that stores information in data blocks connected chronologically through advanced cryptography.

Imagine a public digital ledger where all transactions are permanently recorded. Each page of this ledger represents a block, and all pages are numbered and connected in such a way that it's impossible to alter past information without everyone noticing.

The main innovation of blockchain was creating a decentralized system where no central authority controls the data. Instead, multiple network participants maintain identical copies of the record, ensuring transparency and security.

How Did Blockchain Emerge?

The history of blockchain began long before Bitcoin. In the 1990s, the Cypherpunks, a group of digital privacy activists, were already working on cryptographic technologies to protect information.

In 1991, scientists Stuart Haber and W. Scott Stornetta created the first blockchain prototype, using cryptographic techniques to protect digital documents against tampering. This pioneering work influenced generations of developers and cryptographers.

The definitive milestone came in 2008, when Satoshi Nakamoto published Bitcoin's technical document, presenting blockchain as a solution to create a decentralized electronic payment system. This practical application demonstrated the revolutionary potential of the technology.

How Does Blockchain Work?

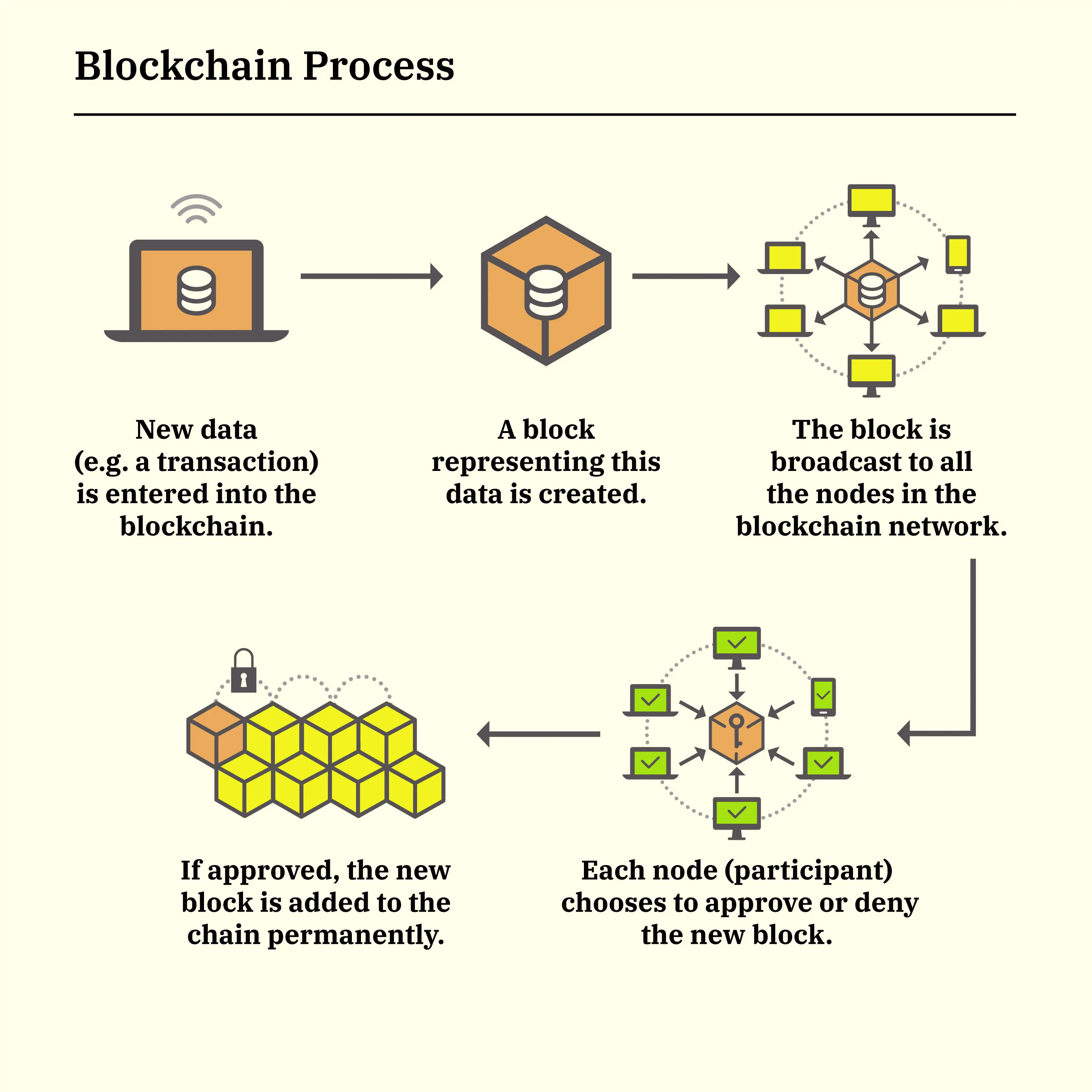

The functioning of blockchain may seem complex, but following some basic steps makes the process clearer to understand:

Block Structure

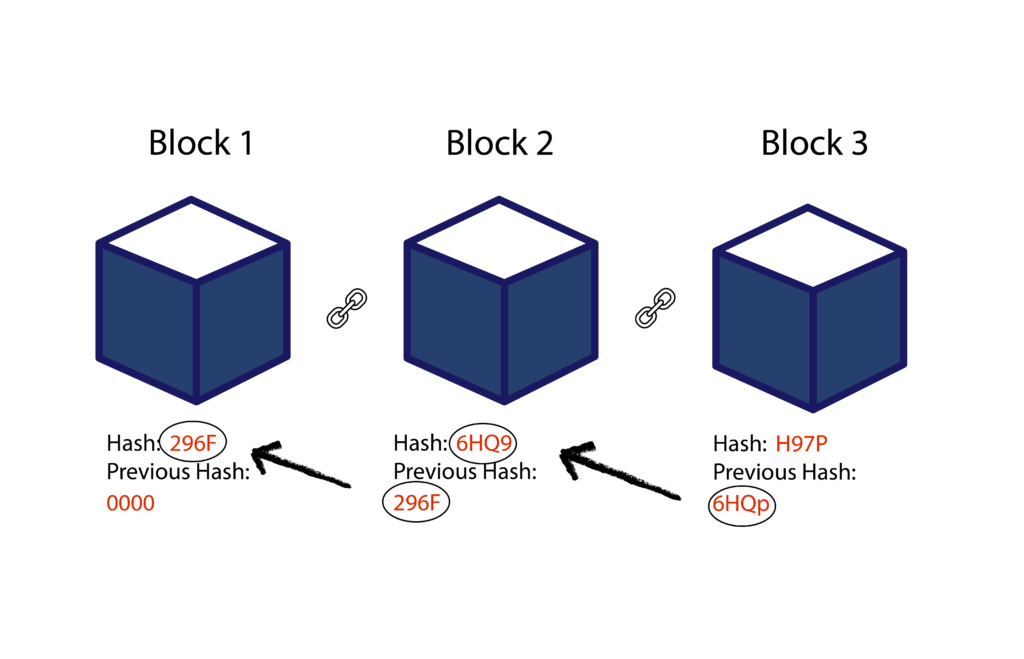

Each block in the chain contains specific and essential information:

Date and time: Timestamp that indicates exactly when the block was created, allowing chronological ordering of records.

Transaction data: Information about transfers, including amounts, origin and destination addresses, without exposing users' personal data.

Unique code: Exclusive identifier code that functions as a "fingerprint" of the block, generated through complex mathematical algorithms.

Previous block code: Cryptographic reference that connects each block to the previous one, creating the "chain" and ensuring sequential integrity.

Validation Process

The process of adding new blocks follows rigorous steps:

1. Transaction request: User initiates a transfer that is transmitted to the entire network of participants.

2. Node verification: Network computers (called nodes) verify if the transaction is valid, checking balances and digital signatures.

3. Mining: Miners compete to solve complex mathematical problems and add the new block to the chain.

4. Network consensus: Other participants validate the solution found by miners before accepting the new block.

5. Distributed update: All network nodes update their blockchain copies with the new validated block.

Cryptographic Security

Blockchain uses extremely secure cryptographic algorithms, such as SHA-256 used by Bitcoin. This function is so robust that even all current supercomputers working together would take more than 2,000 years to break the cryptography.

Mining works by trial and error, where miners test millions of solutions until finding the correct one. The Bitcoin Standard: The Decentralized Alternative to Central Banking explains in detail how this process guarantees network security.

Fundamental Characteristics of Blockchain

Blockchain technology is sustained by three fundamental pillars that ensure its effectiveness:

Decentralization

There is no central authority controlling the network. Instead of depending on banks or governments, blockchain distributes control among all network participants.

This characteristic eliminates single points of failure and reduces risks of censorship or manipulation. Even if some participants leave the network or try to act dishonestly, the system continues functioning normally.

Transparency and Immutability

All transactions are permanently recorded and visible to anyone. Once information is added to the blockchain, it becomes extremely difficult to alter it.

To modify an old record, it would be necessary to alter all subsequent blocks, which would demand an impractical amount of computational power and energy.

Distributed Consensus

Before any new information is added, the majority of network participants need to agree that it is valid. This mechanism ensures that only legitimate transactions are processed.

Different blockchains use various consensus mechanisms, such as Proof of Work (Bitcoin) or Proof of Stake (Ethereum 2.0), each with its specific advantages.

Types of Blockchain Networks

There are different types of blockchain, each suitable for specific needs:

Public Blockchain

These are open networks where anyone can participate, view, and validate transactions. Examples include Bitcoin, Ethereum, Cardano, and Solana.

These networks are completely decentralized and offer maximum transparency. Security is guaranteed by massive user participation around the world.

Private Blockchain

Controlled by specific organizations, these networks allow access only to authorized participants. Companies like Ripple use this model.

Although less decentralized, they offer greater control and privacy for specific corporate applications.

Hybrid Blockchain

Combine public and private elements, allowing organizations to control access to sensitive data while maintaining transparency in other areas.

Consortium Blockchain

Controlled by groups of organizations that share common objectives, such as bank consortiums or industrial supply chains.

Practical Applications of Blockchain

The versatility of blockchain enables applications in various sectors:

Financial Sector

Banks and financial institutions use blockchain for faster and cheaper international payments. The Singapore Stock Exchange implemented the technology to improve efficiency in banking settlements.

Additionally, blockchain enables decentralized financial services (DeFi), offering loans and investments without traditional intermediaries.

Energy and Sustainability

Energy companies use blockchain to create peer-to-peer renewable energy markets. Solar panel owners can sell excess energy directly to neighbors through automated platforms.

Crowdfunding projects allow communities to invest jointly in clean energy infrastructure.

Media and Entertainment

Sony Music Entertainment Japan uses blockchain to manage copyrights more efficiently, reducing costs and increasing productivity.

The technology enables transparent tracking of copyrights and simplifies payments for artists and content creators.

Retail and Logistics

Amazon has patented a blockchain system to verify authenticity of products sold on its platform. This helps consumers identify genuine products and combat counterfeiting.

Logistics companies use blockchain to track products from manufacturing to final consumer, ensuring supply chain transparency.

Healthcare

Hospitals and healthcare systems implement blockchain to protect medical records and ensure secure information sharing among professionals.

Consensus Mechanisms

Proof of Work (PoW)

Used by Bitcoin, this mechanism requires miners to solve complex mathematical problems to add new blocks. Although secure, it consumes a lot of energy.

Proof of Stake (PoS)

Validators are chosen to create new blocks based on the amount of cryptocurrencies they have "staked" in the network. More energy-efficient than Proof of Work.

Proof of History (PoH)

Used by Solana, creates a historical record that proves events occurred at specific moments, increasing transaction speed.

Smart Contracts and Decentralized Applications

Smart contracts are self-executing programs stored on the blockchain that execute automatically when predetermined conditions are met.

These smart contracts eliminate the need for intermediaries in many business processes. For example, a logistics company can configure automatic payments when goods arrive at their destination.

Decentralized applications built on blockchain offer services without central control, from games to social media platforms.

Blockchain vs Traditional Technologies

Differences from Conventional Databases

Traditional databases are centrally controlled and allow modification or deletion of data. Blockchain, on the other hand, distributes control and makes records immutable.

While companies need to trust each other to share data, blockchain creates trust through mathematics and cryptography.

Comparison with Cloud Services

Cloud services offer software as a service and infrastructure managed by centralized providers. Blockchain enables blockchain as a service, but maintains decentralization.

Main Market Blockchains

Bitcoin (BTC)

The first and most well-known blockchain, created specifically for decentralized financial transactions. Uses Proof of Work and focuses on maximum security and decentralization.

Ethereum (ETH)

Platform that popularized smart contracts and decentralized applications. Currently transitioning from Proof of Work to Proof of Stake.

Solana (SOL)

High-performance blockchain that processes thousands of transactions per second, using Proof of History for greater efficiency.

Cardano (ADA)

Academic platform that prioritizes scientific research and sustainability, using Proof of Stake from the beginning.

For those who want to better understand Bitcoin specifically, we have a complete guide about its creation and functioning.

Benefits of Blockchain Technology

Advanced Security

The combination of cryptography, decentralization, and consensus creates an extremely secure system against fraud and attacks. The Only Bitcoin Investing Book You'll Ever Need explores security aspects in detail.

Improved Efficiency

Elimination of intermediaries accelerates transactions and reduces costs, especially in international payments that traditionally take days to process.

Total Transparency

All participants can verify transactions and audit the system in real-time, increasing trust and reducing the need for external auditors.

Simplified Audits

Chronologically ordered and immutable records facilitate accounting and regulatory audits, saving time and resources for companies.

Limitations and Challenges

Scalability

Many blockchains still face speed limitations, processing fewer transactions per second than traditional systems.

Energy Consumption

Mechanisms like Proof of Work consume significant amounts of energy, generating debates about environmental sustainability.

Technical Complexity

Implementation and maintenance of blockchain systems requires specialized knowledge that many organizations still don't possess.

Regulation

Regulatory environments still in development create uncertainty for companies considering technology adoption.

Future of Blockchain

The technology continues evolving rapidly. Second-layer solutions, like Bitcoin's Lightning Network, promise to solve scalability problems.

Interoperability between different blockchains is developing, enabling communication and value transfer between distinct networks.

Companies and governments are experimenting with central bank digital currencies based on blockchain, potentially transforming global monetary systems.

Integration with other emerging technologies, like artificial intelligence and Internet of Things, opens new application possibilities.

Related Concepts

To deepen knowledge about the blockchain ecosystem, it's worth exploring concepts like cryptocurrency staking, which allows earning passive income by participating in network validation.

NFTs also depend on blockchain technology to guarantee authenticity and ownership of unique digital assets.

Understanding these related concepts helps form a more complete vision of blockchain's transformative potential.

Conclusion

Blockchain represents one of the most significant technological innovations of recent decades. Its ability to create trust without intermediaries is transforming sectors from finance to supply chain management.

Although it still faces technical and regulatory challenges, blockchain's potential to democratize access to financial services and increase transparency in organizational processes is immense.

For those seeking to better understand personal financial management and how this technology can impact investments, it's worth studying concepts like emergency funds and understanding cash flow.

Morgan Housel's "The Psychology of Money" Book can help entrepreneurs better communicate about technological innovations like blockchain.

Blockchain is not just the technology behind cryptocurrencies - it's a fundamental infrastructure that can reshape how we think about trust, ownership, and value exchange in the digital age.